The Reserve Bank of India’s Monetary Policy Committee (MPC) on Friday sharply lowered its inflation forecast for 2025–26 to 2%, revising it downward from the earlier estimate of 2.6%. The RBI said the drop reflects an unexpected and steep fall in food prices, along with the impact of recent GST rate cuts.

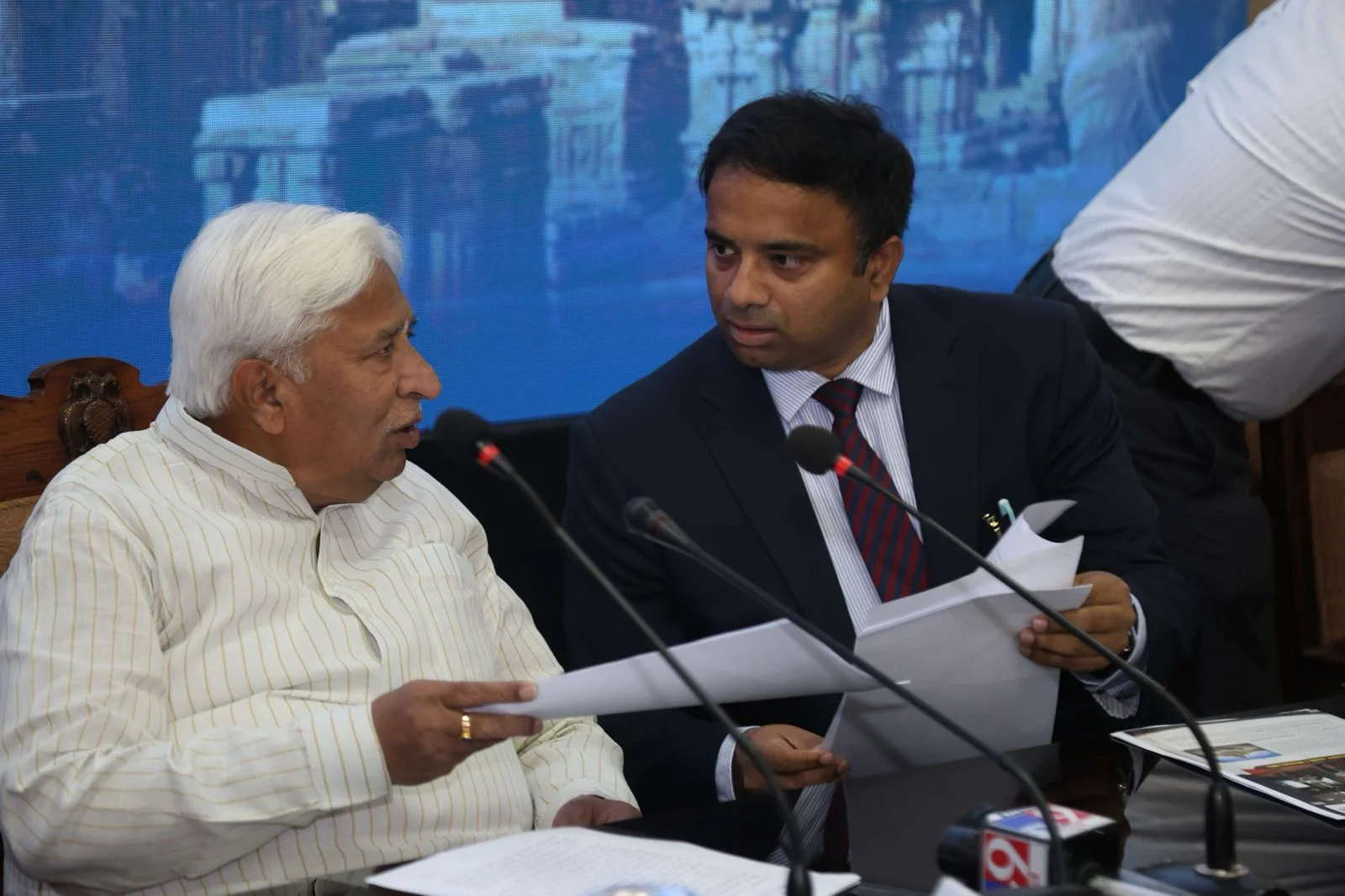

RBI Governor Sanjay Malhotra noted that headline inflation has eased more than anticipated and now appears set to remain softer in the coming months. He said food inflation has been unusually low, while improved kharif output, healthy rabi sowing, adequate reservoir levels, and favourable soil conditions have strengthened food supply prospects.

Malhotra added that core inflation — excluding food, fuel and precious metals — also stayed contained in September and October. Excluding gold, core inflation eased to 2.6% in October, indicating a broader cooling of price pressures.

The RBI expects inflation to stay below earlier projections across the next several quarters. CPI inflation for FY26 is pegged at 2%, with Q3 estimated at 0.6% and Q4 at 2.9%. Inflation in the first half of 2026–27 is expected to remain at or below the 4% target.

With inflation softening and risks remaining balanced, the MPC unanimously voted to cut the policy repo rate by 25 basis points to 5.25%. Malhotra highlighted that headline CPI inflation in October fell to a record low, defying the usual seasonal rise normally seen in September–October.

Source – sarkaritel.com

For more news visit our site: Click here